Non-Resident Mortgages in the UAE How to Assess Your Eligibility

International investors have now shifted their focus to investing in Dubai property market which presents lucistent returns and today is one of the most active segments. To any one thinking about investing in property in Dubai and you are not a resident then it is important that you know who is eligible for a mortgage and how the process is done. Please see below, a guide to understanding non-resident mortgage in the UAE.

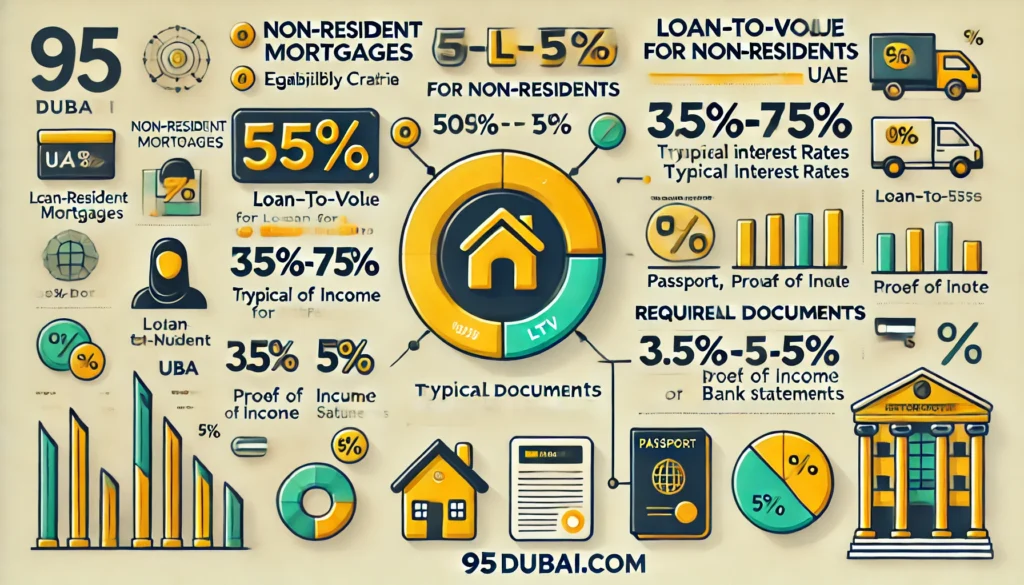

This is usurious for conventional mortgage where borrowers, whether residents or non residents of the UAE can borrow with LTV that fundamentally range from 50% to 75%. Interest rates of non-resident mortgages usually exist in a range of between 3 percent and 5 percent per annum depending on the lender and the borrower. Some sample documents that one is required to provide and the ones which the traveller has failed to include include passport, proof of income, bank statements other financial records.

Dubai Marina, Downtown Dubai and Palm Jumeirah are freehold zones for which the non-residents can buy and actually they legally own it. It is actually a very efficient process and can slightly vary depending on the particularities of the bank and general/specific conditions which can be set in front of the applicant based on any conditions which can be set depending on the applicant’s financial status and the selected property.

Personal Loan Calculator

Eligibility Criteria for Non-Resident Mortgages

- Country of Citizenship: The banks in the UAE has a list of standard that has to be met by the country of the applicant for a non-resident mortgage. Before applying for the particular institution, it is necessary to cheque the list of countries, which are allowed to apply.

- Proof of Income and Employment: Foreigners to be allowed must present adequate evidence that they have stable income. These comprise salary certificates, bank statements, contracts of employment in respect of ‘salaried’ employees, etc. For self-employed individuals, documents including trade licences and company bank statement are mandatory.

- Down Payment: Usually it is necessary for non-residents to pay an initial amount of 20% to 40% of the property. During application for an Unsecured Business Loan, among the requirements is a proof that the down payment funds are available in your bank account.

- Debt-to-Income Ratio: Banks determine your capacity to repay the mortgage with reference to your debt to income ratio. Consequently, a lower KDA signifies the subject firm’s ability to handle more loan repayments relative to the net operating cash flows.

- Credit History: A good credit rating improves the probability of mortgage acceptance and will help in obtaining favourable interest rates. Banks use credit history with which to judge your credit worth.

- Age Restrictions: In their virtual provisioning, most of the banks have set age limit of 21 to 65 years for non-resident applicants. Some banks have certain age restrictions, especially for independent entrepreneurs.

Non-Resident Mortgage: LTV Ratio & Interest Rates

Types of Mortgages Available

- Conventional Loans: They are the same as banking practises involving fixed or variable interest rates.

- Islamic Financing Loans: An ethical source of funding alongside legal conventional loan which is against the dictates of shariah required for Islamic finance.

Steps to Secure a Non-Resident Mortgage

- Research and Choose a Lender: The main research is to find out all the banks and other financial institutions in Dubai that have good offers in non-resident mortgages. Existing lenders and other financial institutions dealing in the local market should be sought who have dealt with foreign investors before.

- Meet Eligibility Criteria: Cheque if you satisfy the requirements by the bank in regard to income and other documentations.

- Prepare Required Documents: Ensure passport copies, proof of income and earnings, bank statements and property documents are collected.

- Submit Loan Application: Get a copy of your mortgage application and fill it and submit it with all necessary documents. The borrower will be ready to give extra details as the loan officer may require.

- Property Valuation: They want to see how much they can lend basing on the valuation they will conduct on the property.

- Loan Approval and Terms Negotiation: After your application, if it is approved you will get a mortgage offer. Pay a lot of attention to the terms and renegotiate if there’s a need to before settling on the financial terms.

Dubai presently has several Free Zone areas where a foreigner is free to own landed property without being compelled to become a resident. These areas are classified into classes such as the residential class, the commercial class and the luxury class; each of these classes having its merits. Many preferred residential areas consist of Dubai Marina – which has some of the most beautiful homes along the shore and Palm Jumeirah – an artificial island that hosts some of the most beautiful homes in the world.

Some of the other budding business hub and other significant commercial markets include Business Bay and Downtown Dubai amongst others, Jumeirah Lake Towers, Dubai International Financial Centre, Dubai Internet City and Dubai Media City amongst others, Emirates Hills and Dubai Hills Estate amongst the other residential property markets that provide luxurious living including golf course residential areas.

List of Dubai Freehold Areas (Category Wise)

Residential Areas

Commercial Areas

Luxury Areas

Banks Offering Non-Resident Mortgages

- Dubai Islamic Bank

- HSBC

- First Abu Dhabi Bank

- Emirates Islamic Bank

- Standard Chartered

These banks provide a range of mortgage options tailored to non-resident investors, ensuring flexibility and support throughout the process.

FAQs: Non-Resident Mortgages in the UAE

Can non-residents get a mortgage in the UAE?

Yes, non-residents can obtain a mortgage in the UAE. Several banks offer mortgage products specifically for non-residents, though eligibility criteria may vary.

What is the Loan-to-Value (LTV) ratio for non-resident mortgages in the UAE?

The LTV ratio for non-resident mortgages typically ranges from 50% to 75%, depending on the lender and property type. Non-residents generally have to make a larger down payment compared to UAE residents.

What is the interest rate for non-resident mortgages in Dubai?

Interest rates for non-resident mortgages in Dubai typically range between 3.5% and 5% annually, depending on the bank, the type of mortgage, and the borrower’s financial profile.

Can a non-resident buy property in the UAE?

Yes, non-residents can purchase property in designated Freehold Zones in the UAE, such as Dubai Marina, Downtown Dubai, and Palm Jumeirah, with full ownership rights.

What documents are required for a non-resident mortgage?

Non-residents typically need to provide a valid passport, proof of income, bank statements, and in some cases, proof of property ownership or investments in their home country.